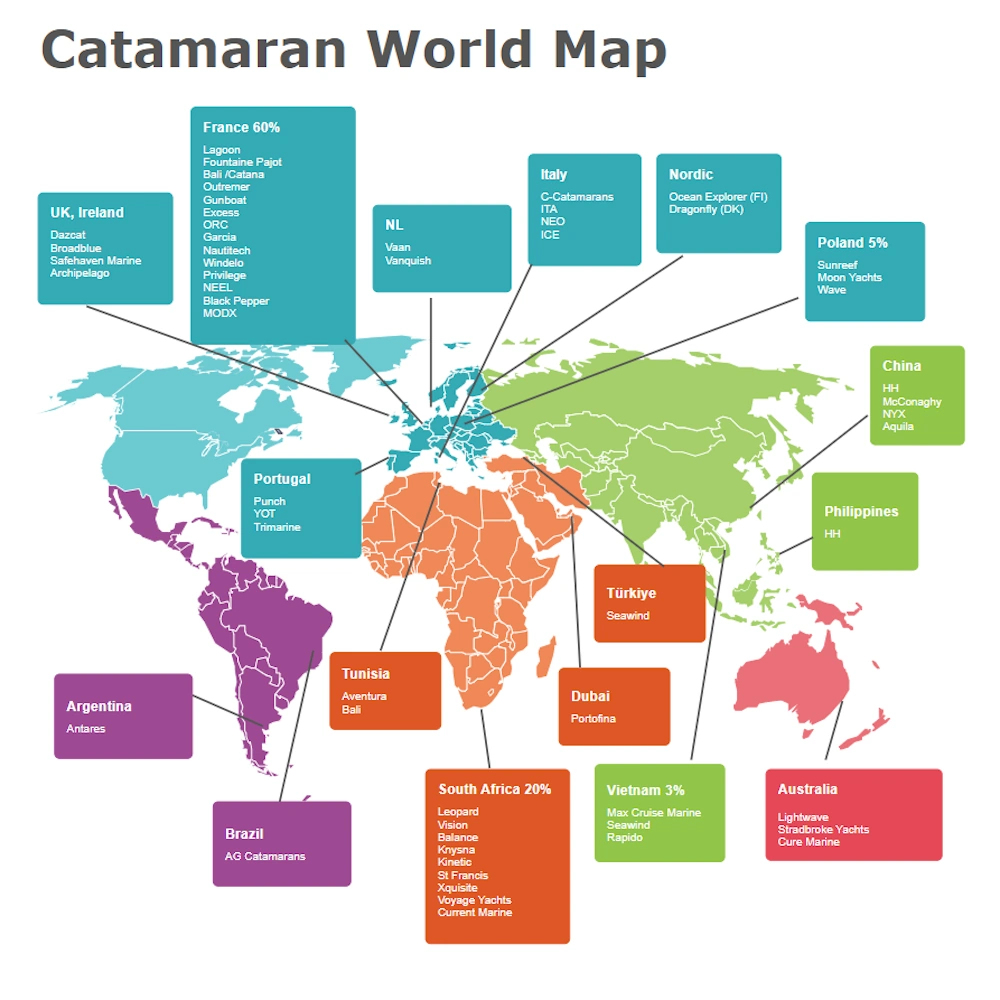

Catamaran World Map

Do you know where Catamarans are made?

Bookmark this for later: the Catamaran World Map. Pinch and Zoom.

Countries

France dominates the scene with approximately 60% of the action followed by South Africa at 20%.

Do you know all of these manufacturers? Who have we missed?

| Country | Est. Global Share | Brands / Yards |

|---|---|---|

| France | 60-65% | Lagoon, Fountaine Pajot, Bali, Catana, Nautitech, Excess, Garcia, Privilege, Outremer, Gunboat, Windelo, NEEL Trimarans, ORC, MODX, Tournier |

| South Africa | 15-20% | Leopard/Robertson & Caine, Balance Catamarans, Kinetic, St. Francis Marine, Xquisite, Voyage, Knysna Yacht Co., Vision, Phoenix Catamarans, Two Oceans Marine |

| Poland | 5-7% | Sunreef Yachts |

| Australia | 3-5% | Lightwave Yachts, Fusion Catamarans, Stradbroke Yachts, Cure Marine |

| China | 2-4% | HH Catamarans, McConaghy, NYX, Alquila |

| Netherlands | 1-2% | Vaan Yachts, Vanquish Yachts (power) |

| Vietnam | 1-2% | Max Cruise Marine, Seawind |

| Tunisia | <1% | Aventura Catamarans, Bali |

| Italy | <1% | C-Catamarans (Comar), ITA Catamarans, NEO |

| UK, Ireland | <1% | Dazcat (UK), Broadblue Catamarans (UK), Safehaven Marine (IE) Archipelago (UK) |

| Spain | <1% | Astilleros Dalmau, Flash Catamarans, Aister Boats, King Marine, North Wind |

| Argentina | <1% | Antares |

| Portugal | <1% | Punch Catamarans, Catana Group (YOT), Trimarine |

| Brazil | <1% | AG Catamarans |

| Thailand | <1% | Asia Catamarans (Phuket), Fusion |

| Turkiye | <1% | Seawind (Izmir) |

| Dubai, UAE | <1% | Portofino Catamarans |

How is France so Successful in this Market?

Key Success Factors

- Boatbuilding Infrastructure

Vendée/La Rochelle cluster: The world’s largest yacht production hub with 500+ composite yards, suppliers, and R&D within a 50km radius. Beneteau/Lagoon factories alone employ 5,000+.

Economies of Scale: Lagoon produces 400+ boats/year at single Marans site; automation cuts costs 30% vs competitors.

Heritage: Multihull pioneers (Fountaine Pajot 1976, Outremer 1984) built supply chains others can’t match.

- Charter Market Synergy

Mediterranean demand: French Riviera/Corsica/Balearics generate a big share of European charter revenue; cats perfect for week-long island hops. Other areas (Greece, Croatia) are dominated by the French suppliers.

MOORINGS/ Sunsail fleets: A large share are Lagoons/Fountaine Pajots—proven durability drives repeat buys. Leopard (SA) also win here.

Tax-efficient leasing: French “LOA” (long-term lease) recovers 20-30% VAT + depreciation for private owners.

- Culture & Export Focus (15%)

Sailing DNA: France has 900,000+ licensed sailors (the world’s highest/capita); Vendée Globe/Match Racing culture feeds the talent pool.

Global brands: Lagoon/Fountaine Pajot = 50% brand recognition; ANCRE export support (80% production exported).

- Overseas Territories

Testing grounds: New Caledonia/Polynesia perfect for bluewater trips; local charter demand.

Overseas sales <5% of total, it’s the mainland that drives the volume.

- EU Regulations

Emission standards: French yards lead hybrid/solar tech (Windelo); smoother CE certification vs non-EU rivals.

Summary

Industrial clustering plus the charter economics create a virtuous cycle. Their huge scale lowers costs. They dominate the charter market with proven reliability. Along with private sales, they reinvest at scale.

South Africa follows a similar charter logic with Leopard/Moorings/Sunsail (also Voyage in the Caribbean) but lacks France’s supplier ecosystem. They are very successful in the premium sector however (Balance, Vision, Knysna, Kinetic.